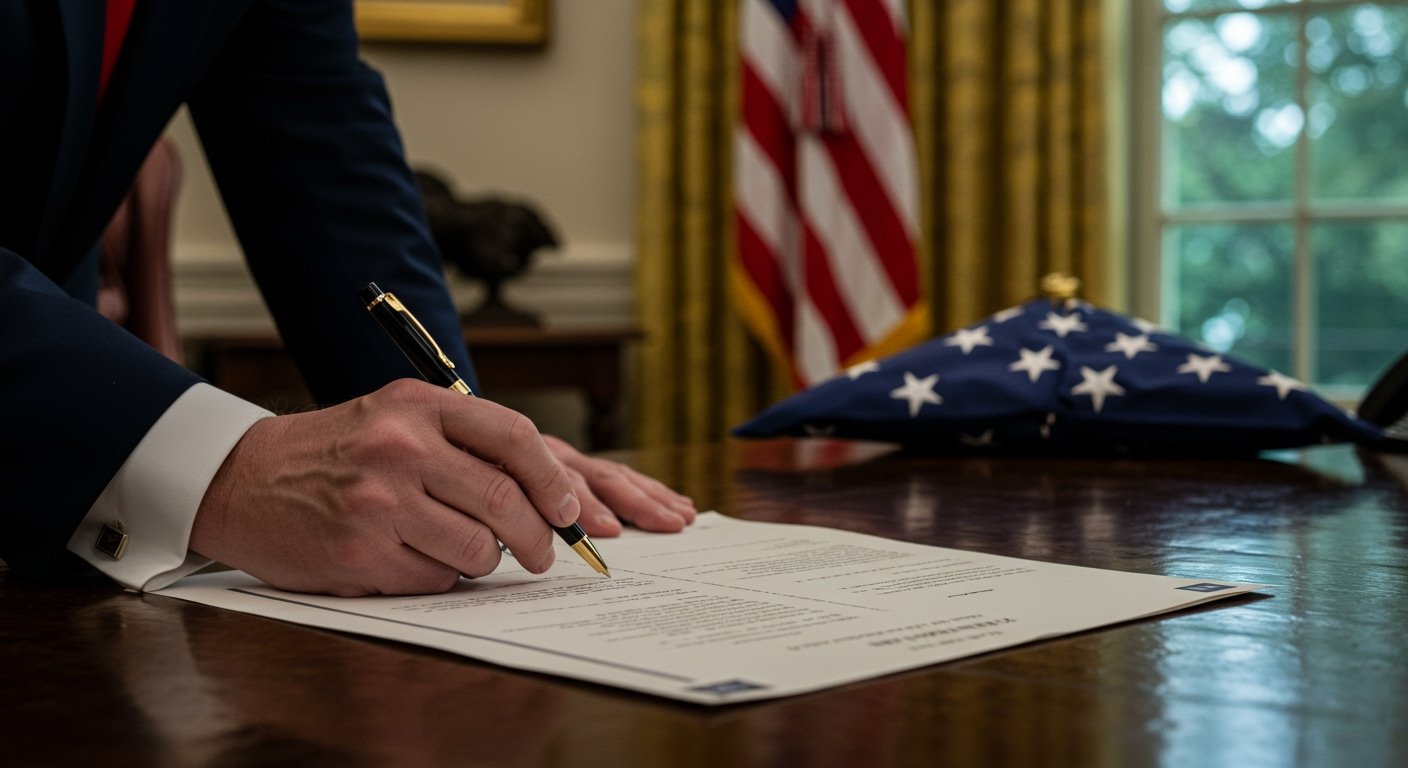

Washington D.C. – A landmark legislative package championed by President Donald Trump, frequently characterized by the president himself as the “big beautiful bill,” has cleared its final hurdles in the U.S. Congress. Having received approval from both the U.S. House of Representatives and the Senate, the extensive measure is now poised for presidential signature, scheduled to formally become law today, July 4, 2025. The bill represents a significant legislative accomplishment for the administration, blending substantial alterations to the tax code with funding directed towards key administration priorities.

Key Tax Measures Central to the Bill

At the core of the newly passed legislation lie provisions enacting sweeping changes to the nation’s tax structure. The bill includes the extension of the 2017 tax cuts, a signature policy achievement from President Trump’s prior term in office. According to information detailed within the summary of the bill’s provisions, the package is estimated to result in approximately $2.2 trillion in tax reductions over a ten-year period. Specific tax relief components highlighted within the legislation include the implementation of no federal taxes on tips or overtime pay for workers, targeted tax relief measures designed to benefit seniors, enhanced tax credits aimed at assisting families with childcare expenses, and the complete elimination of the federal estate, or “death,” tax. These measures constitute a significant portion of the bill’s economic focus and have been lauded by supporters as vital for stimulating growth and providing relief.

Spending Priorities and Major Allocations

Beyond its extensive tax provisions, the “big beautiful bill” allocates substantial funding towards several key domestic and defense spending priorities championed by the Trump administration. The legislation earmarks resources specifically for increasing the number of U.S. Immigration and Customs Enforcement (ICE) agents, a step proponents argue is essential for strengthening immigration enforcement and border security. It also includes significant funding designated for the completion of the border wall project along the entirety of the U.S.-Mexico border, a long-standing and central promise of the President’s platform. Additionally, the bill provides appropriations for the proposed Golden Dome missile defense system, a strategic initiative described by its advocates as crucial for enhancing the nation’s defense capabilities against emerging ballistic missile threats and ensuring national security.

The Bill’s Passage Through Congress

The legislative journey of the bill through the halls of the U.S. Capitol was marked by intense political debate and, particularly in the House of Representatives, significant partisan division. While the measure successfully cleared both the Senate and the House of Representatives, its final passage in the House occurred largely along party lines, secured by a narrow vote of 218 in favor to 214 opposed. This outcome unfolded despite determined efforts by Democratic House Leader Hakeem Jeffries to impede its progress. Leader Jeffries employed a procedural tactic by delivering an extensive eight-and-a-half-hour marathon speech on the House floor, leveraging the opportunity to voice deep opposition and highlight Democratic concerns, though his efforts ultimately did not prevent the bill from passing the chamber.

Strong Opposition and Democratic Critiques

Throughout the legislative process, the package encountered robust opposition, primarily from Democratic lawmakers. Prominent critics, including Congressman Joe Morelle, articulated significant concerns regarding the bill’s perceived beneficiaries and its potential consequences for different segments of the population. Democrats have broadly criticized the legislation, contending that it disproportionately provides “handouts to billionaires and special interests,” arguing that these benefits are realized “at the expense of working families.” Specific points of contention include the assertion that the tax provisions primarily constitute “tax breaks for the wealthy.” Furthermore, opponents have raised alarm over the inclusion of new work requirements stipulated for recipients of programs such as Medicaid and food stamps, warning that these mandates could foreseeably lead to millions of vulnerable Americans losing access to vital healthcare coverage and nutritional assistance.

Conclusion

With the congressional approval secured and the presidential signature anticipated today, July 4, 2025, the “big beautiful bill” is set to reshape significant aspects of the nation’s fiscal and security policies. Its passage underscores the current political landscape and the ability of the administration to enact its legislative agenda despite considerable partisan hurdles. As the bill is implemented, the debate surrounding its economic impact, its effects on different socioeconomic groups, and the effectiveness of its spending provisions is expected to continue shaping political discourse and policy outcomes in the years to come.